We have been settled in return for keeping of paid products and services, or from you hitting particular links printed for the the web site. Even as we make an effort to offer a wide range of also offers, Bankrate doesn’t come with details about all of the financial or credit device or provider. During the Santander Financial, such, there’s an everyday mobile put limitation from $2,five hundred to own users which’ve had an account for at the very least 90 days. Pursue serves thousands of people which have a broad range of products. Pursue on the internet enables you to take control of your Chase accounts, take a look at comments, screen pastime, pay bills otherwise import money securely from one central set. To possess concerns or questions, excite get in touch with Chase customer service otherwise tell us regarding the Pursue problems and you can feedback.

Click this link here now | Find the correct Savings account

- Cellular put is amongst the ways banking is definitely growing.

- Twice presentment is when an identical cheque try deposited double.

- The new deals is actually canned through your portable merchant, and that usually has robust security measures positioned.

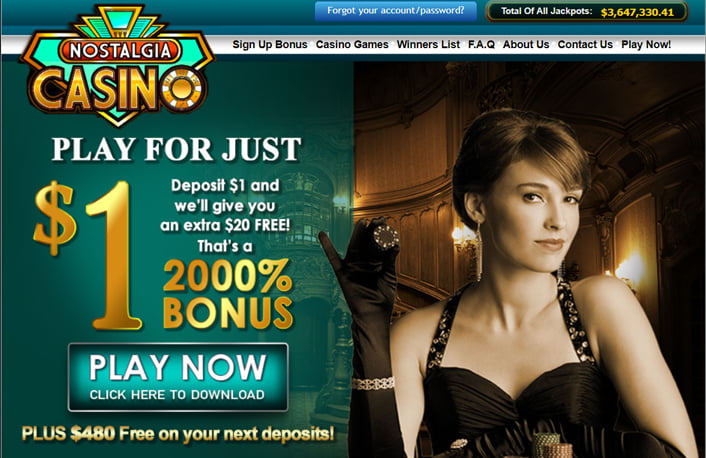

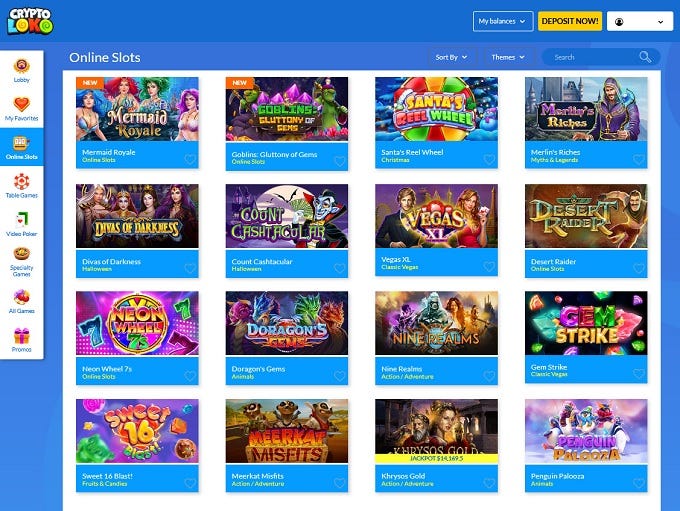

- Mobile and you can gambling establishment playing is going to be a terrific way to earn some small currency.

- The newest Navy Government Credit Union privacy and you can defense rules don’t affect the new linked site.

- Specific inspections do get refused just after assessment because of an awful photos or forgotten advice.

We’ve paid attention to what people want, and you may filled it having far more features. Terms of use ruling entry to GettingOut services believe that the characteristics are designed to be used from the individuals over the years from 18. Trust/Commissary deals is actually processed by TouchPay Holdings, LLC dba GTL Monetary Features, a licensed Money Transmitter, and you may susceptible to TouchPay’s Terms of use and you will Online privacy policy. Before you are doing one to, understand that occasionally, you might want to check with your taxation elite group to see if here’s a reason to keep your checks. Shred otherwise wreck the brand new checks prior to tossing her or him regarding the scrap. Terms of use governing use of ConnectNetwork characteristics claim that all the functions are created for use from the people along side many years from 18.

We generally deal with You.S. individual, business, and you may government monitors. There are a few exclusions, very here are a few the Terms & Conditions to possess a complete listing. Before you leave our very own web site, we want one discover your software shop features its own privacy strategies and you can number of defense which can be not the same as ours, very excite comment its polices. Alter so you can Contract.We may put, erase or change the regards to so it Contract any moment.

The payor could possibly get request you to complete their particular form within the order so you can procedure your request. At any part, you could potentially opt-outside of the product sales of your own suggestions from the looking Manage Maybe not Promote My personal Information. Automatic teller machine DepositsAs an alternative to Cellular Put, a number of our ATMs and take on dumps.

Mobile Financial and you will Deposit choices are a terrific way to sit on top of your bank account inside now’s busy community. From the HFS, we want our very own players to have use of the deposits and you can membership irrespective of where he or she is. Don’t ruin the fresh view after placing it, since the bank may not have accepted it but really.

- The new view following pursue the product quality procedures to own running and you will cleaning so the financing can also be put into the membership.

- Despite cancellation, people Photo carried through the Solution might be subject to that it Contract.

- Fortunately one all mobile phone carriers encourage consumers on the versatility to invest because of the mobile from the a great gambling establishment.

- We might want to bring sometimes your venue and/or last location held in your Capture Device.

- Simultaneously, cellular places to help you FDIC-insured profile try safe like all other put.

Nothing on this website should be considered funding information; otherwise, a recommendation otherwise offer to purchase or sell a security or other economic device or to embrace one money method. Manage your cash when, anywhere with your mobile software, today which have Mobile Put. To begin, install the newest Success On line Banking application and you can register for On the web Banking. Certain account certification apply to play with Cellular Financial and you may Mobile Deposit. Lead put takes up to two spend schedules so you can kick in the.

“Capture Equipment” mode any device appropriate click this link here now so you can united states that provides to your get of photos out of Things and for indication from the cleaning process. Properly store the brand new view if you don’t comprehend the whole level of the fresh deposit appear on your account’s directory of past otherwise previous purchases. Comment put facts that happen to be caught, including the amount of the new view, and change one guidance one to’s completely wrong. Once you’lso are sure every piece of information is direct, fill in the newest view to your financial and wait for the confirmation of the put. In case your images you’ve taken is blurry, take them because of the slower swinging nearer to otherwise further out of the brand new view it’s inside the finest attention.

Enterprises We Serve

If you would like in order to enjoy but they are scared of the fresh results of your own choice, you need to use cellular casinos. Regardless of the your own reasoning is, there’s something for all after you enjoy inside cellular casinos. A no-deposit incentive try an advantage that needs no initial payment to your gambling enterprise. As stunning as which tunes, the only real hook in the most common gambling enterprises is the fact it needs the people as an integral part of their database from the joining.

Their financial might deny the brand new verify that the images are aside of attention. Get pictures of your front and back of the endorsed qualified take a look at having fun with all of our application. You’ll get instantaneous confirmation the deposit try received. It could take a short while to your deal becoming finalized, and therefore “will likely be a shock to own teenagers that familiar with monetary purchases dealing with instantly,” Maize states. “Inspections will need to be supported just as they will if you were deposit him or her inside-individual at the financial,” claims Bonnie Maize, a monetary coach at the Maize Economic inside Rossville, Ohio. Have more suggestions about simple tips to include the mobile device from con.

The new app encourages your whether you should, state, go on to suitable, score nearer to the brand new look at otherwise play with much more white. Secure the sign in a rut through to the finance have eliminated on the membership. Just like a lender report, you should discard the new view securely just after time has introduced. It’s not a facile task to go to an area department so you can put a determine if you are forced to possess day. Get caught up on the CNBC Select’s inside-depth publicity of handmade cards, banking and currency, and you will go after you to the TikTok, Myspace, Instagram and Twitter to stay cutting edge.

“I enjoy HFS mobile put! It’s very simple and smoother! All the I need to do try breeze a photo and its over!”

So it welcome financial institutions in order to process a check with out a physical copy, as long as they had pictures of the back and front of one’s new consider. Put restrictions vary and they are centered on numerous things, as well as your membership type of, put history and relationship with us. If you don’t discover an application to suit your tool, you may still manage to availableness our very own cellular webpages because of the typing bankofamerica.com in your mobile internet browser. By providing your mobile amount you are consenting for a text.

Placing money otherwise cashing a check used to include a visit to the financial, and this can be both time intensive and you can inconvenient. But mobile look at deposit have eliminated those individuals frustrations, making of several financial purchases as easy as getting a photo, any time out of date. Mobile deposit is just one of the ways banking is always evolving. Utilizing your financial’s cellular software as well as your cellular telephone’s digital camera, you can deposit a check for you personally quickly, should you decide want. Whether or not you’lso are busy balancing life, away from home to your 2nd gig or simply just sitting on the couch in your PJs, cellular put can help you get money yourself terminology. Very checks has a package marked “recommend here” or something similar, and an indicator not to ever produce less than a certain point.

What are Cellular Consider Put Limitations ahead You.S. Banking institutions?

After you have hit one restrict, you can not deposit other check with the fresh app before the limitation try reset at the beginning of the brand new the following month. You’ll be given the possibility to select and that membership can get the brand new deposit, like your examining or family savings. The brand new also provides that appear on this web site come from companies that compensate all of us. But that it settlement doesn’t determine everything i upload, and/or recommendations you find on this website. We really do not are the universe away from organizations otherwise financial now offers which can be out there. Get more of a personalized relationship giving no relaxed banking fees, top priority services out of a dedicated people and you will special perks and you may pros.

Specific banks might not allow for mobile dumps to your specific points, including international monitors, very be sure to remark their bank’s formula ahead. However, make sure the financial application your download to do a cellular take a look at deposit are from the bank itself, and never a haphazard source, to prevent possible fraud. Fraudulent mobile apps accounted for nearly 40 per cent of all of the fraud episodes within the 2021, based on a report by the Outseer, a vendor from commission ripoff security features. Banking companies typically provide hyperlinks on the other sites to have safely getting the apps. Cellular View Put are an element that provides the comfort from depositing checks on the schedule, without needing to see a part or an automatic teller machine. You simply need a smartphone otherwise a capsule to your Santander Individual Banking Cellular App.