The accurate recording of inventory purchases is fundamental to effective inventory management and financial reporting. If the purchase is made in cash, credit the Cash account to decrease the company’s cash on hand, showing that cash has been spent to acquire inventory. In each case the purchase transaction entries show the debit and credit account together with a brief narrative. For a fuller explanation of journal entries, view our examples section. The entity uses a purchase journal only when it uses a manual to record accounting information.

Purchases journal definition

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

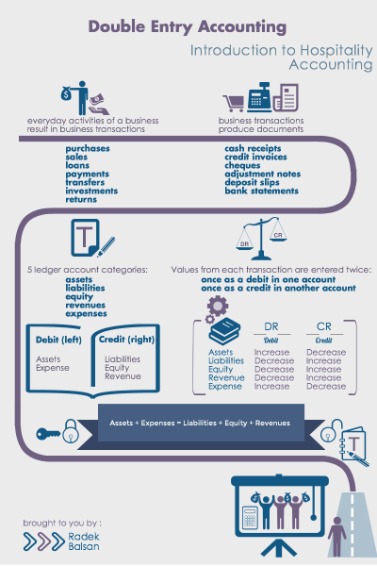

- Usually, debits have a left alignment in the entry field while credits are indented or aligned with the right side of the line.

- You need to note which account funds are taken from to pay for a purchase.

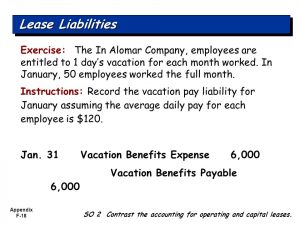

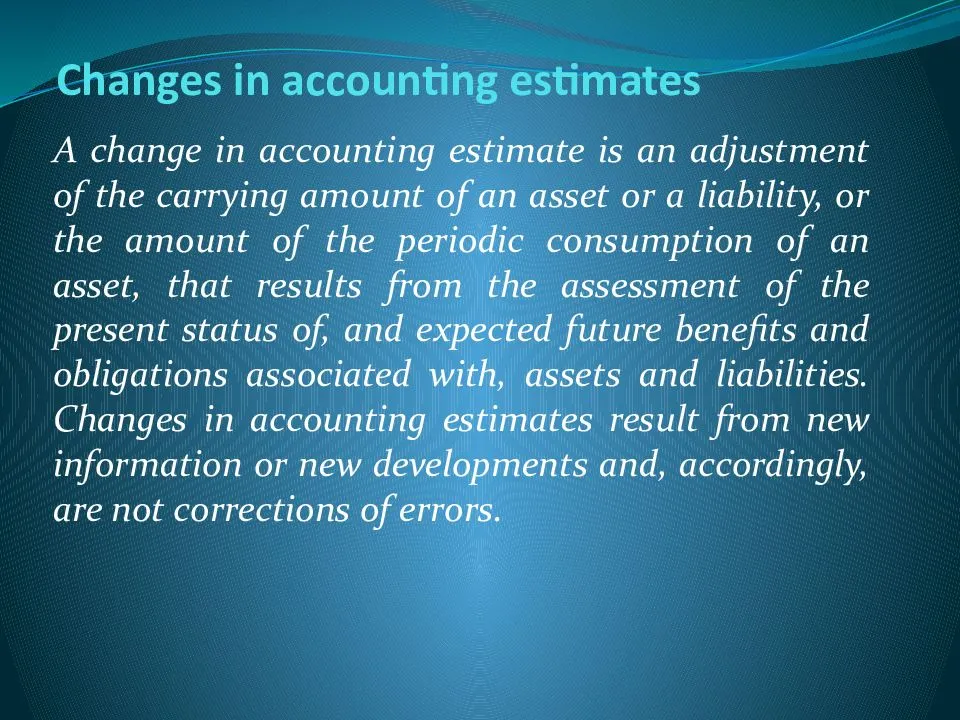

The accounting principle required the entity to record all of those transactions as liabilities. You should update your purchases journal as often as necessary to reflect the most current information. This may be daily, weekly, or monthly, depending on the type of business you run and the products and services you offer. Other names used for the purchases journal are the purchases book, purchases daybook, and the credit purchases journal.

What is a Purchases Journal?

Postings from the purchases journal follow the same pattern as postings from the sales journal. Each day, individual purchases should be posted to the vendor’s account in the accounts payable subsidiary ledger. To record an inventory purchase, debit the Inventory account to increase your stock assets, and credit either Cash or Accounts Payable, depending on whether the purchase was made in cash or on credit. The debit to the Inventory account shows an increase in assets, as the company now has more inventory. The credit to the Cash account decreases the company’s cash on hand, reflecting the payment for the inventory.

our end-of-day newsletter where we process the stuff.

In practice, each line item would include the information listed above. Recordings of these transactions should be following the debit and credit roles. For example, credit purchases should be an increase in credit as it is the liabilities. If those purchases are for inventories, then inventories accounts should be debited. The main information in the purchase journal includes the name of the entity, accounting period, date, suppliers’ accounts, invoices date, and payment terms. A purchase journal is a special journal that uses to record all of the transactions related to purchases on credit.

Purchases Journal FAQs

Auditors routinely engage in this activity when they are verifying transactions that have been posted to the general ledger. Each purchase invoice is recorded as a line item in the purchases journal as shown in the example below. In this example, all the items are assumed to be inventory purchases and some information has been omitted to simplify the example.

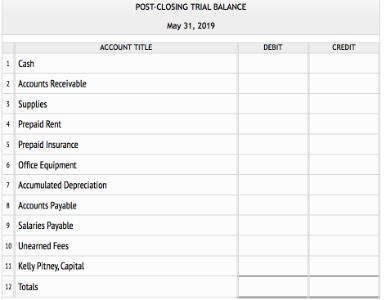

Entities might purchases goods or services and make the payments immediately to suppliers by cash. The balance in this list is compared with the balance in the general ledger accounts payable account. This procedure helps to verify that all the postings have been made correctly.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finally, at the end of the month, a list of the individual subsidiary accounts is created. This list is often called the accounts payable trial balance (or a schedule of accounts payable).

Included in these assets can be tangible (machinery and equipment, real property) and intangible assets (customers, technology, trade names, intellectual property, goodwill, other intangibles). Let’s illustrate with examples for a company named “Garden Supplies Co.” that purchases inventory both in cash and on credit. The cash receipts journal is used to record all receipts of cash for any reason. Anytime money comes into the company, the cash receipts journal should be used.

Besides these specific journals, accounting teams also use a general journal. A general journal tracks transactions that do not fall into one of the four categories. An accounting team may use other specialty journals to track certain types of transactions. Over time, the journal offers insights into business and spending trends. Purchases on credits are any purchase of products or services that the entity takes the products or users the services now and pays later.

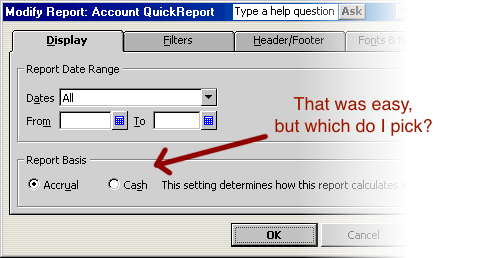

While credit transactions are recorded in the Purchase book, cash purchases are entered in a general journal. It is worth mentioning that only the credit purchase of goods is recorded in such journals, and any capital expenditure is excluded. At the end of each accounting period (usually monthly), the purchases journal totals are used to update hsa tax information for your employees the general ledger accounts. As the business is using an accounts payable control account in the general ledger, the postings are part of the double entry bookkeeping system. The purchase book records all the credit purchases in one place, and details of Suppliers, invoice number, currency, quantity, and other details are mentioned there.

In addition, the paper has produced several television series, podcasts — including The Daily — and games through The New York Times Games. The New York Times has been involved in several controversies in its history. The Times maintains several regional bureaus staffed with journalists across six continents, and has received 137 Pulitzer Prizes as of 2023, the most of any publication, among other accolades. This increases liabilities, indicating an obligation to pay the supplier in the future.