The best things about Wave are that it is easy to set up and that it has a free plan with all the features that many businesses need. A downside is that it lacks advanced accounting features, like project management and inventory accounting. If you’re interested in the program after reading my detailed Wave review, you may sign up for the free plan (Starter) or upgrade to the paid version (Pro) for $16 monthly. Wave also offers a free app to help you manage your invoices on the go. With Wave Invoicing, you’ll be able to track, edit, send and pay invoices from any mobile device. In addition, Wave allows you to manage multiple businesses on one free account and uses double-entry accounting, which is ideal for accountants and tax time.

Negative Wave Reviews & Complaints

- This is particularly true if you don’t have much accounting experience and would like an easy-to-use, fully functional tool.

- Wave’s introduction of a second plan on top of its free accounting tool makes it a more scalable solution than its previous one-plan-only structure.

- Businesses in the 36 other U.S. states can only sign up for Wave’s self-service payroll plan.

- It offers essential functionality that will help you pay bills, invoice customers, and track your expenses—even in the free Starter plan.

- You can invite your accountants, bookkeepers or other business partners to Wave via email and designate their user roles.

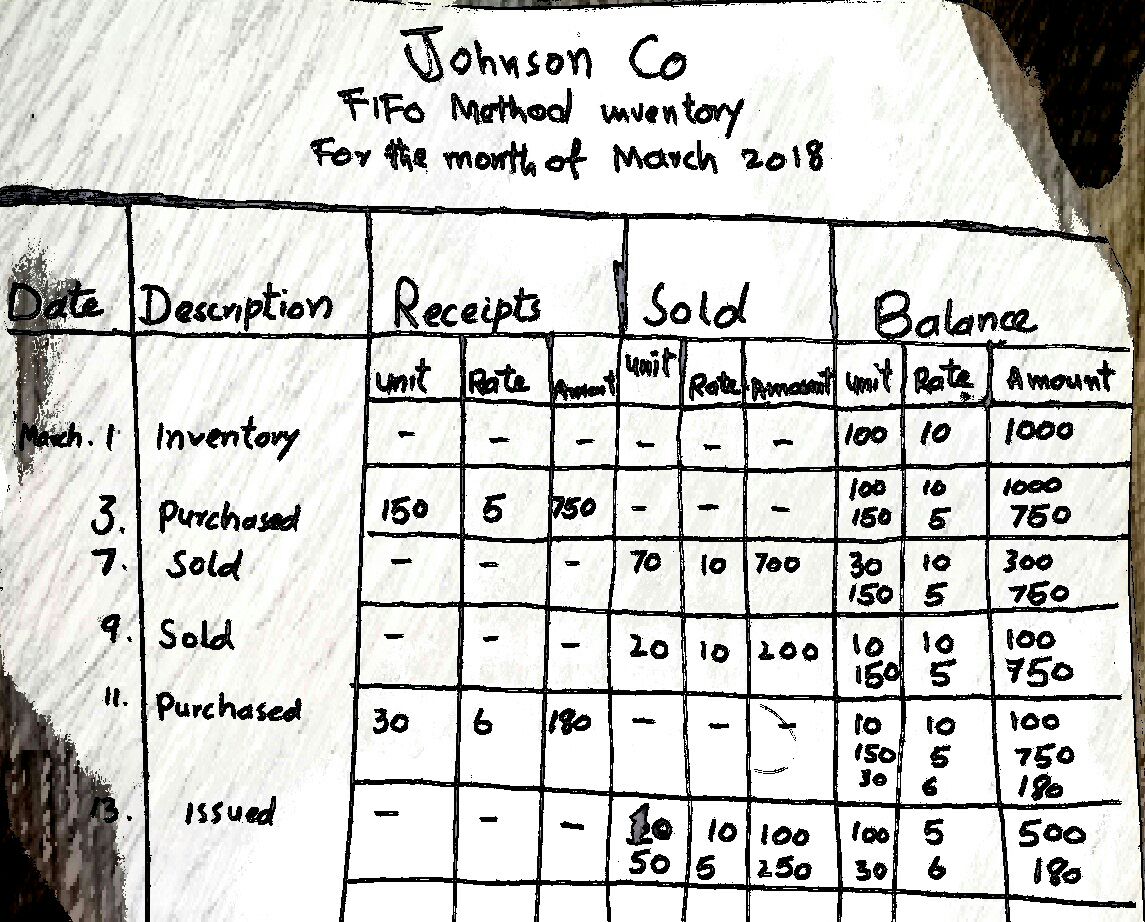

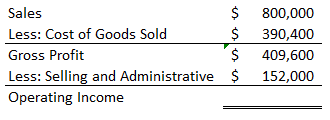

Wave’s Starter plan still offers the basic features businesses with simple accounting needs can use to manage their finances. Pricing is transparent, there are a decent number of add-ons, and even the paid plan is pretty affordable. These factors contributed to our rating of 4.4/5 for Wave’s pricing and fees. You can set up multiple sales tax rates, apply them to invoices, and generate reports to help with tax compliance. Wave’s inventory management feature is very basic, which is why it lost points in my evaluation.

Wave Accounting is an affordable bookkeeping and accounting software service that doesn’t sacrifice features for the sake of pricing. Its expense, income and cash-flow tracking features are perfectly suited to freelancers, solopreneurs and other self-employed individuals who want to keep their accounting software expenses low. Until then, the software is still a good account for uncollectible accounts using the balance sheet and income statement approaches solution for small business owners looking for simple, easy-to-use accounting software that won’t break the bank. Wave’s customer support resources and new Wave Advisor services make it easy for people with limited accounting experience to learn the software.

Best Accounting Software for Small Businesses of 2024

Customer statements are simple—a choice of outstanding invoices or account activity one at a time. New features here include attachments, automated payment reminders, and customizable templates for customer messages. Are you a service-based freelancer in need of a basic, user-friendly way to track your finances without spending money on features you don’t need? If that’s the case, Wave Accounting will likely live up to your expectations. Its invoicing and online payment acceptance features can help you get paid while ink to the people its reporting and money management tools ensure you stay on track for tax season and future business growth.

Should your business use Wave Accounting?

As of 2024, Wave has introduced a second paid plan that gives small businesses the option to scale up with Wave as they grow. Users of the free plan are limited to using Wave’s Help Center or Mave, the support chatbot. Fortunately, the Help Center provides plenty of guides and information to help with most issues, and the software is intuitive enough that this support option will be sufficient for most users. The software must also have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops. Support network refers to a community of software users that can extend professional help to businesses. Having an independent software expert perform the bookkeeping is good for overall ease of use.

You’ll need to watch for this carefully and then delete the imported transaction to avoid duplication. It’s not ideal, but Wave does clearly indicate imported transactions that have to be dealt with. The primary problem is that the reconciliation doesn’t allow for entries in the books that have not yet cleared the bank, like outstanding checks. This presents a challenge if you write many paper checks as you will be unable to reconcile your account until all outstanding checks have cleared the bank. Moreover, you can integrate QuickBooks with hundreds of third-party tools available in the app marketplace. There are also add-on Intuit services like QuickBooks Payroll or where to file addresses for businesses and tax professionals filing form 4868 QuickBooks Time.

I will never use this free software -they just cancel features!!!

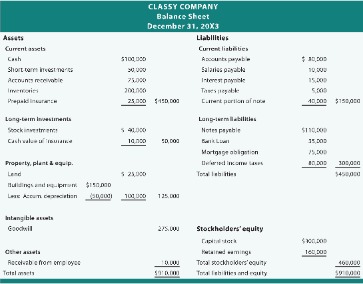

The advisors are trained employees of Wave who will assist you with your bookkeeping needs. It also has a new company wizard to walk you through the setup process and that prompts you for the basic information needed. While the reports are accurate, they’re not very professional looking—especially the balance sheet that doesn’t provide a beginning and an ending balance.