You can still claim items that are less than $2,500 as assets, but some small businesses prefer to claim them as expenses. This innovative feature enables users to simply snap a photo of a receipt or invoice, and QuickBooks utilizes advanced technology to extract key information such as date, amount, and vendor. This significantly reduces the manual https://www.quick-bookkeeping.net/ effort required for data entry, ensuring accuracy and efficiency in expense categorization. It is important to keep in mind that subcategories should be used judiciously, and the hierarchy should remain manageable. Therefore, consider creating subcategories only for significant and distinct transaction types that require further classification.

Loan and Interest Accounts

This ensures that the transaction is properly balanced and recorded in QuickBooks. Learn what the chart of accounts is and why it’s important to set up correctly in QuickBooks Online. You can create items in QuickBooks by setting up a new product or service using the Product/service information form, which you can access from the Products and Services tab under the Sales menu. Choose the type of item you wish to create and provide the required information, like the item name and relevant fields depending on the type selected. By categorizing the expense as Rent, the transaction is properly classified and grouped with other rent-related transactions in your reports.

Step 3: Defining Category Details

In summary, choosing the right category for each transaction is a crucial step in effective transaction management in QuickBooks. Categories in QuickBooks are pre-set classifications that allow you to classify your transactions into different types, such as income, expenses, assets, and liabilities. These categories serve as a framework for organizing and tracking your financial data effectively. Managing the financial aspects of a business is crucial for success, and QuickBooks Online is a powerful tool that offers a range of features to streamline the process. One such feature is the ability to add categories, which allows you to organize your financial transactions and track them more efficiently.

Bank feed/bank rules

This detailed categorization allows businesses to effectively manage their budgets and identify where resources are being allocated. By accurately categorizing software expenses, businesses can gain insights into their spending patterns, make informed decisions on future investments, and streamline financial tracking. By customizing these categories, businesses can ensure that their financial records accurately reflect the specific nature of their expenses and income sources. This customization allows for more detailed reporting and analysis, enabling better decision-making and financial management. This feature streamlines the classification of expenses and revenue, providing a granular view of the financial landscape.

It streamlines tax preparation by providing a clear breakdown of deductible expenses, saving time and resources during tax season. It helps streamline audits and simplifies the process of generating financial reports for stakeholders, enabling transparent and reliable financial analysis. You can create categories in QuickBooks Online by setting up a new account in the Chart of accounts screen.

Utilizing Tags for Further Classification

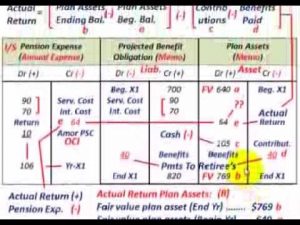

You have easy access to all the common financial statements like balance sheet, profit and loss (P&L) statement, cash flow statements and taxes filed. You can take a printout of these statements for your accountant and send it across to them at the time of filing or invite them to view https://www.online-accounting.net/types-of-audit/ these statements without needing a login ID or password. Invoicing is one of the most crucial functions for many businesses, especially those that provide services or rely on freelancers. QuickBooks makes it easy to create invoices either from scratch or from an earlier estimate.

To help fill the gap, here is a list of definitions to commonly used terms in QuickBooks’ small-business software. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. The inventory management and job costing features are more robust in QuickBooks compared to QuickBooks Online. As you accept payment for any item in the inventory, the right expense account is updated and reflected automatically in taxable income.

Ensure to assign each account a unique name and account number for easy identification. Regarding the Detail Types of your expense categories, it is mainly for tracking the description of each spending. While this does not reflect the reports, most businesses would prefer to use a more defined naming structures split out for each account type.

By setting the category as active or inactive, you have control over whether it is available for use in transactions. This can be helpful when you want to temporarily disable a category or prevent accidental selection. Inactive categories will not appear in dropdown menus when recording transactions, reducing clutter and streamlining the selection process.

- Choosing the right account type sets you up with accurate reports, such as the balance sheet and profit and loss reports, so you can analyze the financial health of your business.

- The inventory management and job costing features are more robust in QuickBooks compared to QuickBooks Online.

- Small business owners do not use QBOA, as that is really for the accounting firm and staff to manage their work and their QBO clients.

- When you choose the Expense account type, it refers to expenses related to the normal business operations such as advertising or promotion, office supplies, insurance, legal fees, charitable contributions, and rent.

Custom categories enable you to track specific expenses or revenue streams that may not be covered by the default options. This level of flexibility allows you to tailor your financial management to your specific industry or business requirements. The Chart of Accounts provides an overview of your financial structure, including assets, liabilities, income, and expenses. By accessing this section, you can begin the process of creating new categories to accurately track your business transactions and financial health. By leveraging QuickBooks Online’s categorization features, businesses can streamline their financial reporting processes and make informed strategic decisions based on accurate and detailed financial data.

Therefore, consider consolidating similar types of transactions under broader categories to maintain simplicity and efficiency. By regularly reviewing and maintaining your categories, you can ensure accurate financial tracking and reporting in QuickBooks Online. Take advantage of the flexibility and ease of editing or deleting categories to keep your Chart of Accounts organized and solved menlo company distributes a single product. the company’s aligned with your evolving business needs. Neglecting the regular review and adjustment of categories in QuickBooks Online can result in outdated classification, inaccurate reporting, and suboptimal alignment with the business’s financial management needs. This can result in data becoming scattered across numerous categories, making it difficult to track and analyze effectively.

When categorizing transactions, users can assign specific categories to each transaction, such as office supplies, travel expenses, or sales revenue. With QuickBooks’ user-friendly interface, creating custom categories is a straightforward process, providing businesses with the ability to adapt their accounting system to accommodate specific business requirements. Implementing custom categorization can significantly streamline the tracking and management of financial transactions, leading to improved accuracy and efficiency in overall financial management.