This flexibility allows you to tailor the software to suit your specific business requirements, providing you with the information you need to stay organized and in control of your finances. In the following sections, we will explore the steps you need to take to add, edit, and delete categories, as well as how to define the details of each category. QuickBooks Online ensures that changes you’ve made to categories are reflected across all linked transactions. This feature is particularly useful for maintaining accuracy in your bookkeeping and accounting records.

How can accurate financial tracking benefit my business?

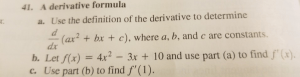

This customization allows for more detailed reporting and analysis, enabling better decision-making and financial management. Secondly, precise expense categorization ensures compliance with accounting standards and regulatory requirements. This is particularly crucial for maintaining accurate financial records and facilitating a smooth auditing process. Inaccuracies or oversights in categorizing fees could lead to financial discrepancies, potentially causing complications during audits or financial assessments.

This article is from the book:

Using categories in QuickBooks Online enables businesses to generate comprehensive reports based on specific financial categories, facilitating in-depth tracking and analysis of business finances. Setting up categories in Quickbooks Online is a fundamental step to customize financial tracking, expense management, and income categorization to align with the unique needs of a business. Categorizing software expenses in QuickBooks is essential for monitoring and managing technology costs, and it involves understanding software expense categories and accurately categorizing software-related expenditures. Manually categorizing income in QuickBooks involves assigning specific income categories to transactions, ensuring accurate financial recording and analysis of revenue sources.

How to create an invoice in QuickBooks

Count on me to provide unwavering support and assistance, guiding you toward the optimal support channels to ensure successful editing of your categories according to your specific needs. Now, you can assign this class to transactions in QuickBooks Desktop for better categorization and reporting. All fees, regardless of their type, can be categorized by platform and go into a separate account. After you turn on advanced pricing, you can choose the Lists →Price Rule List command to display the Price Rule List window.

Recording each platform’s fees into a separate category in QuickBooks

- This structure is essential for maintaining financial accuracy and ensuring compliance with accounting standards.

- The Categorize feature in QuickBooks Online enables users to efficiently classify and organize transactions, providing a streamlined approach to accurate financial tracking and analysis.

- Deleting unused categories in QuickBooks plays a crucial role in optimizing the software for efficient financial management.

- This process plays a vital role in maintaining the financial health of the business, as it allows for clear visibility into the movement of funds.

- This innovative feature enables users to simply snap a photo of a receipt or invoice, and QuickBooks utilizes advanced technology to extract key information such as date, amount, and vendor.

- It allows businesses to streamline their operations, understand their profitability, and make informed decisions.

This process ensures that all expenses are systematically recorded, enabling businesses to analyze their spending patterns and make informed financial decisions. By properly categorizing purchases and supplies, QuickBooks facilitates efficient supply management, enabling businesses to track their inventory levels and make informed purchasing decisions. This helps businesses maintain organized financial records and easily monitor their income and expenses.

For those just starting out or adding new products or services to their portfolios, QuickBooks Online offers a range of video tutorials and even a trial period to support you. Plus, when you integrate with Method’s Items App, you can create and edit these categories in a few clicks, and they’ll sync with your QuickBooks account immediately. I too am looking to edit some of my categories and when I go to products and Services and hit the More box I just get the option to Run Report. You can also go to all your lists to access the product categories section, and you can edit them from there.

Categorizing software expenses in QuickBooks involves accurately assigning technology-related expenditures to specific software expense categories, ensuring precise financial tracking and analysis of technology costs. For businesses utilizing QuickBooks Online, there’s a possibility to streamline and automate this categorization process, which direct income vs indirect income with examples can significantly enhance efficiency. In this article, we’ll explore the importance of tracking expenses related to fees and delve into the valuable functionality provided by Synder Smart Rules within QuickBooks Online. By the end of this article, businesses will gain valuable insights into optimizing their financial tracking processes.

Next, you can assign a suitable name to the category and apply a categorization method that aligns with your business’s bookkeeping practices. It’s crucial to ensure the accuracy of classification, as it impacts financial reporting and analysis. They bring you clarity and insight by grouping products and services in your sales and inventory reports. This means you can easily see which categories are driving your business and make informed decisions accordingly.

The people involved in daily processes will have the most to say about what would increase their productivity. So, make sure to support your team members through the implementation of new categories https://www.quickbooks-payroll.org/ and get their input to make them functional. Categories also play a crucial role in budgeting and forecasting by giving you a detailed view of your company’s financial standing.

The addition of new categories within QuickBooks allows businesses to further refine their inventory and transaction categorization, adapting the system to evolving business needs and operational realities. Understanding your business needs is the foundational step in categorizing tools within QuickBooks, involving an evaluation of product categorization, financial requirements, and overall business realities. For categorized transactions, you’ll need to undo the process to bring them back to the For review tab. Categories in QuickBooks Online are instrumental for budgeting and forecasting, providing businesses with the necessary insights to effectively plan and manage their financial resources. Next, review the existing accounts and identify any that need to be customized, added, or removed.

These tools offer small businesses the capability to track inventory levels, manage purchase orders, and generate insightful reports that aid in decision-making. With QuickBooks, users can also automate invoicing, track expenses, and reconcile bank transactions, bolstering their accounting processes. The diverse nature of QuickBooks tools caters to the unique needs of different businesses, providing scalable solutions that grow alongside the company’s requirements. This process allows businesses to adapt to changes in their financial structure, identify potential cost savings, and allocate resources effectively.

By aligning tools with the specific needs of the business, you can optimize productivity, minimize costs, and foster sustainable growth. The platform offers tools for streamlining customer relationships, managing expenses, and generating insightful reports that aid in informed decision-making. These tools play a crucial role in simplifying business operations and enhancing productivity. Tools in QuickBooks encompass a wide array of features and functionalities designed to streamline various aspects of business management, ranging from inventory and accounting to overall operational efficiency. Excessive creation of categories in QuickBooks Online can lead to complications in financial categorization, reporting inefficiencies, and challenges in deriving meaningful insights from income and expense categories. They allow businesses to categorize their expenses, such as office supplies, utilities, or marketing, which helps in tracking where the money is being spent.

Properly categorized transactions also facilitate tax preparation and audits, ensuring compliance with financial regulations. It provides a clear overview of how money flows in and out of the business, offering valuable insights for improving https://www.kelleysbookkeeping.com/double-entry-accounting-defined-and-explained/ financial performance and optimizing expenditures. Businesses can create specific categories for customers and vendors in QuickBooks Online, facilitating streamlined financial management and reporting for client and supplier transactions.

When categorizing transactions, users can assign specific categories to each transaction, such as office supplies, travel expenses, or sales revenue. This categorization process allows companies to effectively track and analyze their income and expenses for each product or service. By organizing items into distinct categories, businesses can gain valuable insights into their sales trends, cost patterns, and overall profitability.