A company’s accounting policies can change the calculation of its debt-to-equity. For example, preferred stock is sometimes included as equity, but it has certain properties that can also make it seem a lot like debt. Specifically, preferred stock with dividend payment included as part of the stock agreement can cause the stock to take on some characteristics of debt, since the company has to pay dividends in the future. Banks deducting business expenses and other lenders keep tabs on what healthy debt-to-equity ratios look like in a given industry. A debt-to-equity ratio that seems too high, especially compared to a company’s peers, might signal to potential lenders that the company isn’t in a good position to repay the debt. Having to make high debt payments can leave companies with less cash on hand to pay for growth, which can also hurt the company and shareholders.

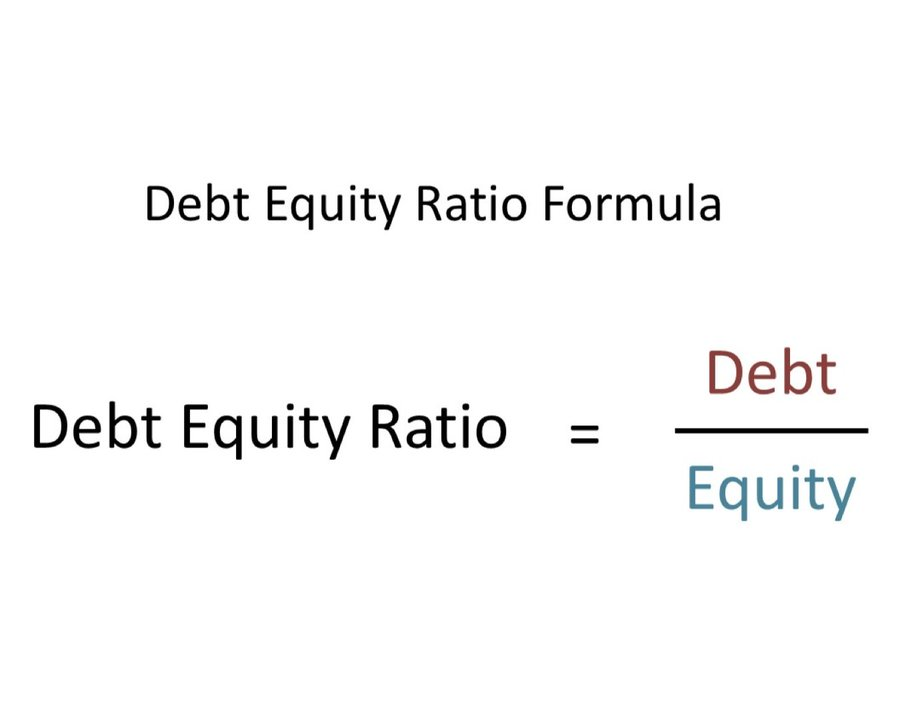

How to Calculate the Debt-to-Equity Ratio

And, when analyzing a company’s debt, you would also want to consider how mature the debt is as well as cash flow relative to interest payment expenses. It’s useful to compare ratios between companies in the same industry, and you should also have a sense of the median or average D/E ratio for the company’s industry as a whole. You can find the inputs you need for this calculation on the company’s balance sheet.

Everything You Need To Master Financial Modeling

For example, a company may not borrow any funds to support business operations, not because it doesn’t need to but because it doesn’t have enough capital to repay it promptly. Many companies borrow money to maintain business operations — making it a typical practice for many businesses. For companies with steady and consistent cash flow, repaying debt happens rapidly. Also, because they repay debt quickly, these businesses will likely have solid credit, which allows them to borrow inexpensively from lenders. Using excel or another spreadsheet to calculate the D/E is relatively straightforward.

Putting the D/E in Context

If the company is aggressively expanding its operations and taking on more debt to finance its growth, the D/E ratio will be high. Investors, lenders, stakeholders, and creditors may check the D/E ratio to determine if a company is a high or low risk. In contrast, service companies usually have lower D/E ratios because they do not need as much money to finance their operations. A lower D/E ratio suggests the opposite – that the company is using less debt and is funded more by shareholder equity.

If earnings outstrip the cost of the debt, which includes interest payments, a company’s shareholders can benefit and stock prices may go up. The depository industry (banks and lenders) may have high debt-to-equity ratios. Because banks borrow funds to loan money to consumers, financial institutions usually have higher debt-to-equity ratios than other industries.

However, in this situation, the company is not putting all that cash to work. Investors may become dissatisfied with the lack of investment or they may demand a share of that cash in the form of dividend payments. At first glance, this may seem good — after all, the company does not need to worry about paying creditors. If a D/E ratio becomes negative, a company may have no choice but to file for bankruptcy.

- By learning to calculate and interpret this ratio, and by considering the industry context and the company’s financial approach, you equip yourself to make smarter financial decisions.

- It is a measure of the degree to which a company is financing its operations with debt rather than its own resources.

- The results of their IPO will determine their debt-to-equity ratio, as investors put a value on the company’s equity.

- Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2).

A steadily rising D/E ratio may make it harder for a company to obtain financing in the future. The growing reliance on debt could eventually lead to difficulties in servicing the company’s current loan obligations. In the banking and financial services sector, a relatively high D/E ratio is commonplace.

If the D/E ratio of a company is negative, it means the liabilities are greater than the assets. One limitation of the D/E ratio is that the number does not provide a definitive assessment of a company. In other words, the ratio alone is not enough to assess the entire risk profile. Some investors also like to compare a company’s D/E ratio to the total D/E of the S&P 500, which was approximately 1.58 in late 2020 (1). The general consensus is that most companies should have a D/E ratio that does not exceed 2 because a ratio higher than this means they are getting more than two-thirds of their capital financing from debt. Simply put, the higher the D/E ratio, the more a company relies on debt to sustain itself.

This comprehensive article delves into the intricacies of the debt/equity ratio, its significance in financial analysis, calculation methodology, and interpretation. Debt-to-equity is a gearing ratio comparing a company’s liabilities to its shareholder equity. Typical debt-to-equity ratios vary by industry, but companies often will borrow amounts that exceed their total equity in order to fuel growth, which can help maximize profits. A company with a D/E ratio that exceeds its industry average might be unappealing to lenders or investors turned off by the risk. As well, companies with D/E ratios lower than their industry average might be seen as favorable to lenders and investors.

The detailed multi-page Analyst report does an even deeper dive on the company’s vital statistics. It also includes an industry comparison table to see how your stock compares to its expanded industry, and the S&P 500. In other industries, such as IT, which don’t require much capital, a high debt to equity ratio is a sign of great risk, and therefore, a much lower debt to equity ratio is more preferable. Investors can use the debt/equity ratio as part of their fundamental analysis to assess a company’s financial stability and risk.