Once any differences have been identified and rectified, both internal and external records should be equal in order to demonstrate good financial health. Conversely, identify any charges appearing in what are the consequences of overstating your accounts receivable the bank statement but that have not been captured in the internal cash register. Some of the possible charges include ATM transaction charges, check-printing fees, overdrafts, bank interest, etc.

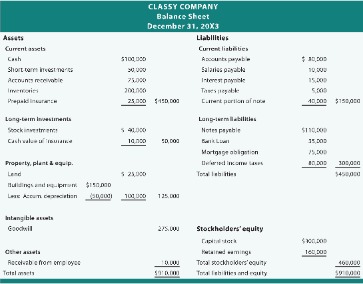

Reconciling other balance sheet accounts

Account reconciliation is an internal control that certifies the accuracy and integrity of an organization’s financial processes. In such a situation, there can be inter-company deposits made, depending on the requirements of different companies. However, since each of the group companies has its legal entity and the books of accounts also need to be maintained separately. To ensure that all cash balance, liabilities, and assets are updated, periodic accounts reconciliation is required. The objective of doing reconciliations to make sure that the internal cash register agrees with the bank statement.

- Learn how businesses like a fintech, Tala, and 7-Eleven streamline financial operations using payment reconciliation software.

- This transparency is vital for establishing trust with investors, lenders, and other stakeholders.

- With more teams working remotely than ever before, siloed data causes even greater risks.

Check your financial statements against other business systems

At the same time, this means that your team will then have more time to allocate to value add responsibilities, creative solutions, and strategic thinking. Crush complexity, reduce uncertainty, and illuminate data with access to best-in-class automated insights and planning, budgeting, forecasting, reporting, and consolidation functionalities. Prophix is a private company, backed by Hg Capital, a leading investor in software and services businesses. More than 3,000 active customers across the globe rely on Prophix to achieve organizational success. When every department has its own method for managing these transactions, with few controls to standardize processes, you may have to go through inaccurate ledgers to prepare an accurate balance sheet. The more manual processes are involved in your organization’s day-to-day transactions, the more opportunities are created for errors and inaccuracies.

Balance sheet reconciliation checklist: 4 steps

Are your reconciliations roll-forwards of recent activity or a simple listing of what is in your general ledger? Companies that close within a short window often rely more heavily on estimates and accruals, which may not be exact. Validating the data through balance sheet review and account reconciliations reduces your exposure to risk, fraud and malicious attempts to manipulate numbers.

Manual reconciliation processes are more complex when balance sheet transactions require reconciliation across multiple general ledgers, ERPs, invoices, and bank accounts. There are specific checklists that you can, however, follow to do manual reconciliations across your balance sheets. HighRadius’ AI-based account reconciliation software can help streamline the entire balance sheet reconciliation https://www.personal-accounting.org/ process. The software offers automated workflow management, GL account-specific reconciliation templates, AI-powered matching, and a collaborative workspace for review and approval. Accounts payable teams must reconcile payments regularly to avoid double-processing them. The process involves matching the amounts that your vendors bill and comparing them to the company’s accounts payable documents.

How to complete a bank reconciliation

Like many other financial processes, balance sheet reconciliation is difficult, time-intensive, and has the potential to be fraught with errors. Here are some challenges to watch out for as you work through your organization’s https://www.business-accounting.net/what-are-the-importance-of-ifrs/ transactions. Similarly, when a business receives an invoice, it credits the amount of the invoice to accounts payable (on the balance sheet) and debits an expense (on the income statement) for the same amount.

You will usually see some of the most common accounting incidents stem from compliance personnel and auditors. If financial statements are inaccurate, it can lead to bigger issues in the short and long-term when it comes to audits. One of the most time-consuming aspects of performing account reconciliation is extracting and compiling the necessary data from the various systems, and even possible disparate spreadsheets. Instead, a reconciliation solution like SolveXia combines all your data and systems to centralize the records you need to compare. Given the manual effort, it is also likely to be error-prone, which can lead to larger issues if financial statements are incorrect.

However, if there wasn’t a discount granted, then there would need to be further investigation to understand and remedy the differences. Few finance processes are as frequent and labor-intensive as the month-end… Account reconciliation can be a daunting task for financial teams of all sizes. Document your findings Leave a record of any investigation and the result, so controllers, auditors, and other professionals can track down any changes you’ve made. This can also help accelerate future reconciliations by identifying and documenting recurring issues.

That means any errors that crop up will be carried over as well, making reconciliation even more important. One of the most time-consuming parts of reconciliation is centralizing all the data you need, both for your general ledger and the supporting documentation you’ll be comparing it against. That data will often be spread out over multiple tools and spreadsheets, and too often you’ll find transactions hidden in a tool that’s gone unused for months too late in the process. Investigate and explain the differences, if any Identifying any errors in your general ledger (or GL) isn’t enough; you need to solve them! Sometimes, identifying and explaining the differences is as simple as spotting typos and similar data entry errors. Other times, you’ll need to investigate multiple systems to find the source of the error.

According to a study by IBM, 88% of all spreadsheets contain at least one error. Companies that rely heavily on spreadsheets for balance sheet reconciliation may find it challenging to keep up with the pace of business and ensure the accuracy of financial statements. Therefore, accurate financial reporting relies on an accounting process that includes solid internal controls, with balance sheet reconciliation being one of the most critical controls. Account reconciliation is the process of cross-checking a company’s financial records with external documents, such as bank statements.