To better understand which work days are unpaid, let’s use an example of what a bi-weekly pay period looks like in January 2023. After you run payroll, the accrual liability amount gets changed into an expense because you’ve paid it. This change gets reflected in the general ledger using journal entries, which we’ll cover later. Payroll accruals are also important for internal accounting because https://www.bookstime.com/ they help your company to determine how much you spent on payroll during any given month. As well as prevent accounting errors such as underpayments, overpayments and also ensures your payroll team stays compliant with regulations. For example, if the employee’s annual salary is $60,000, divide that by 52 to calculate their weekly rate, then divide that by five to get their daily rate.

What is an example of a payroll accrual?

This might be employee salaries, health care benefits, payroll taxes, or Social Security. To keep tabs on accrued payroll and gain insight into your business’s finances, keep in mind these sources of payroll accrual. Alongside salaries and wages, bonuses and commissions form extra payroll accruals, similar to sails that harness the wind to propel the ship. These components of accrued payroll must be accurately tracked and recorded, like a ship’s captain charting the wind’s direction and strength. The most significant part of accrued payroll is the employees’ regular salaries and wages. This includes the pay for the hours employees have worked during a specific period, but the payroll date falls in the next period.

Add any commissions, bonuses and overtime pay

When the need for leave is unforeseeable, an employer may require that a covered employee provide notice as soon as practicable on the day the employee intends to take paid sick leave. Employers must allow eligible employees to use accrued paid sick leave no later than on the 30th calendar day following the employee’s start date. Employees may use paid sick leave for their own illness or injury, or if they are a victim of domestic violence or a sex offense. Accrual accounting records income and expenses when they are earned or incurred, regardless of when the actual payment is made. This is like a ship’s captain noting the ship’s position at a given time, irrespective of the distance covered or the journey remaining. Shifting labor costs can be equated to the changing tides in our ocean analogy.

Employee benefits

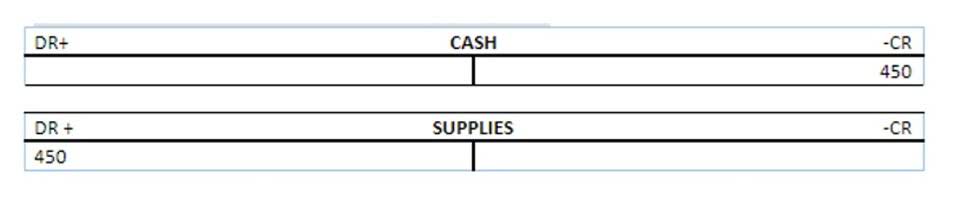

In that journal entry, you’re recording all of the deductions you have to take, as a business owner, from the employee’s check. For transparency and visibility, employees can find these deductions on their pay stubs. The second entry for the employer-paid taxes will also similarly impact the equation.

Accrued payroll refers to all forms of payroll compensation that a business owes its employees but has not yet paid out. Revised every release as payroll periods are completed (with imputed data replaced with actual data when received). These require that such data is only used for the purpose of carrying out functions of the ABS. No individual information collected under the Census and Statistics Act 1905 is provided back to the Registrar or ATO for administrative or regulatory purposes.

Calculate your employee’s wages

This entry ensures that the expenses are recognized in the period they are incurred, aligning with the accrual basis of accounting. As a ship modifies its course due to shifting winds and currents, businesses must make adjustment entries for payroll accruals to cater to alterations in payroll expenses between payment periods. These entries reconcile the difference between the last payment for a particular pay period and the date the accountant prepares the company’s financial statements for the accounting period.

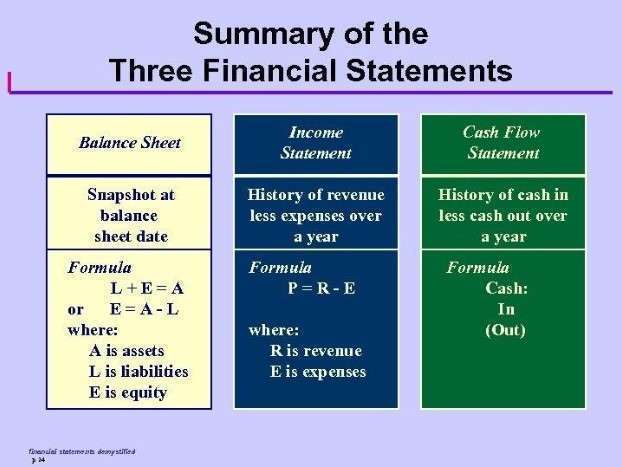

Tracking accrued payroll is a valuable tool for a business to compare their income to their expenses for a given period of time. To do so, multiply your employee’s (gross) hourly wage with the number of hours worked during the pay period for which you want to calculate accrued payroll. Cash accounting is a method by which transactions are only recorded when cash comes in or out. It is a simpler method of accounting compared to accrued payroll, which records pending payroll expenses that the business hasn’t paid yet.

- This includes wages, salaries, and other forms of employee compensation for a specific pay period.

- Accrued payroll is the money that a business owes its employees for work performed during a given pay period but has not yet paid out.

- Accrued payroll refers to the accumulation of wages and benefits earned by employees which are yet to be paid.

- This will ensure your journal entries have additional eyes on them before they post; it can also be helpful if you’re out on a day that payroll journal entries need to be posted.

- The accounts that you need to set up to track payroll will generally be an expense account or a liability account.

- Employers with less than 20 employees (small employers) began transitioning to STP on 1 July 2019.

- Yes, businesses can generally deduct accrued payroll on their taxes because it represents an incurred expense — even though it has not yet been paid.

Sign up for a Gusto plan and get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled. Below is a list of the accounts you will generally need to set up on your chart of accounts to track all payroll-related activities, along with a brief description of each account.

Paid time off (PTO)

- Accrued payroll is a collective account that records all the wages, salaries, bonuses, etc., to show the amount earned by employees but yet to be paid by the employer.

- The payroll jobs index, available from 4 January 2020, provides a measure of changes in payroll jobs over time from the week ending 14 March 2020.

- Employers are responsible for following the ESST requirements most favorable to their employees.

- The ATO person-level Client Register comprises demographic information such as sex, month and year of birth, and state/territory of residential address.