UpTrader takes satisfaction in its state-of-the-art CRM system and remains dedicated to steady enhancements and variations in accordance with business requirements. We be positive that with our Forex CRM answer, you will be a step ahead in the ever-evolving Forex market. In the crypto world, market liquidity performs an integral position in moderating elements that heighten worth volatility. The consolidation of financial flows from a quantity of sources into one liquidity pool by way of liquidity aggregation also allows for ongoing consolidation of the order guide. This ensures instantaneous execution of each buying and selling transactions, thereby conferring a bonus when purchasing assets on the market worth.

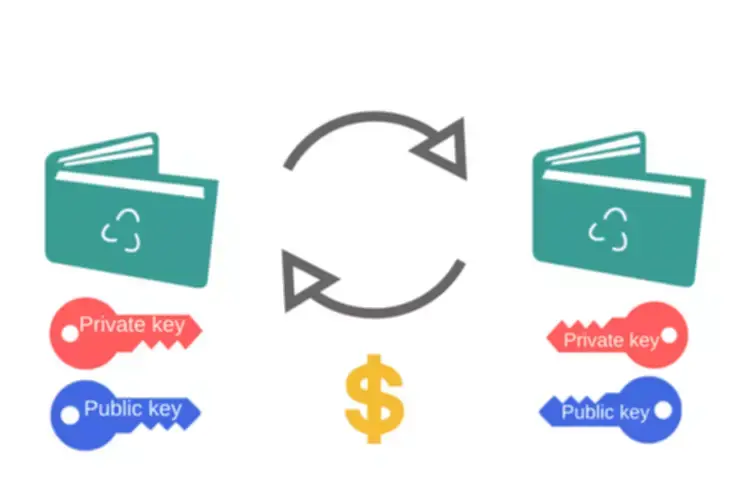

By collaborating with brokers utilizing the C-Book mannequin, traders achieve access to both market making and no-dealing companies from a single broker, which can result in higher pricing and more liquidity. However, these brokers additionally require consideration since traders could not all the time know whether they are receiving the most effective out there price or if the dealer is taking https://www.xcritical.com/ up risk themselves. An A-Book broker conducts enterprise by sending customer orders to external liquidity suppliers in the interbank. This ensures that deals are carried out at competitive costs and that the dealer does not revenue from the trades. In a sector where profitability is closely tied to spreads, getting a liquidity supplier that gives essentially the most aggressive costs becomes crucial.

That’s why our CRM has integrated fast name features allowing managers to make calls instantly from the shopper list, avoiding the necessity to open separate home windows for each shopper. Managers even have the freedom to estimate the quality of leads and flag promising or fake registrations to maximize their productiveness. In order to make evaluation simple and easy, we integrated knowledge visualization tools similar to charts and dashboards.

Overview Of Foreign Currency Trading

This signifies that the dealer doesn’t profit from their losses or endure losses from their positive aspects. Instead, the dealer earns revenue via spreads, commissions, or transaction charges. A-Book foreign exchange brokers make their income via a small mark up on the spread/commission that you immediately pay when placing trading orders. Assume the spread from the liquidity provider is three pips, your A Book broker could list it on their platform as 4 pips, guaranteeing them a 1 pip revenue.

Consider the costs and complexities of integrating with various liquidity suppliers. Routing sure clients or trade sorts via their very own guide whereas sending others to liquidity suppliers allows C-Book brokers to balance income technology and ethical considerations. On the opposite hand, B-Book brokers take a special view on buyer trades, which can result in conflicts of curiosity. Although a B Book buying and selling platform might provide lowered buying and selling prices and quicker commerce execution, value manipulation and information leakage can occur.

The A-Book model’s main benefit is the elimination of conflict of curiosity. Unlike B-Book brokers, who might profit from consumer losses, A-Book brokers earn from trading volumes. This ensures honest remedy for traders, providing clear pricing and tighter spreads, interesting especially to large-volume accounts. To be more particular, when a shopper places an order, the dealer immediately offsets that place available within the market, ensuring that there is no direct affect on the outcome of the trade.

Providers

Their capability to offer liquidity and shrink bid-ask spreads does not just advantage individual traders but in addition helps to cultivate a stronger, extra durable monetary system. Through facilitating trading, market makers assist the general fidelity of financial markets, permitting participants to carry out trades extra competently and with lesser transaction expenses. Another liquidity supplier provides a 5-pip unfold and expenses a fee of $10.

Starting from $999 per 30 days, our Basic service tier, your journey with our strong foreign exchange CRM answer begins. This bundle contains an account administration module, a feature-rich help interface, built-in deposit/withdrawal functions, and a built-in pockets, amongst many different provisions. Also, your operations get the much-needed tech bolster with MT4/MT5 and cTrader integrations. However, if your operations require something more elaborate, our choices scale accordingly. We understand the significance of real-time analytics and the position it plays in profitable buying and selling methods. This is why we now have built-in Power BI analytics into our Forex CRM resolution, providing purchasers with an expansive, easy-to-interpret comparative view of any side of their enterprise.

Introduction To A-book And B-book Forex Dealer Fashions

Behind the scenes, brokers function considered one of three order execution fashions — the market-making A-Book, no-deal-risk B-Book, or hybrid C-Book strategy. Understanding how every works is essential to discovering an optimal match based mostly on factors including transparency, liquidity access, and danger tolerance. This article covers the core traits and tradeoffs of every model. Read on to discover which technique works greatest and which to avoid in any respect prices.

Price risk acceptance means that the dealer does nothing preventative. In the event that the market strikes in opposition to the broker, the dealer will run all of the losses, and vice versa. Commission is probably certainly one of the broker’s sources of income within the A-book mannequin. Even though the prices of entry and exit have been the identical for the dealer and their client, the consumer pays commissions to the broker for the execution.

Buying And Selling Platform Growth

This fastidiously woven integration makes our foreign exchange CRM resolution not solely technologically advanced but in addition intuitive and convenient to make use of. It only takes a day to implement our Forex CRM, be it with MetaTrader four, MetaTrader 5, cTrader, or any other buying and selling platform. As a foreign exchange CRM provider, we perceive the challenges of operating in a extremely competitive and demanding trade. In order to differentiate yourself from your friends, you need one thing awe-inspiring that can drive clients to you.

Traders get better market access and quicker execution, much like A-Books, alongside B-Books’ aggressive spreads and leverage choices. Yet, ensuring transparency and managing conflicts of curiosity, where brokers revenue from shopper losses, current challenges. The revenue margin of an A-Book forex dealer is decrease statistically, but it’s extra regular. In the foreign exchange market, it is broadly identified that % of merchants lose their initial investment within six months, which works to the advantage of the forex B-book dealer. But don’t neglect about unanticipated occasions, which occur frequently and trigger B-book brokers to incur large losses, often for many months at a time. Spreads are the hole between the ask and bid prices, whereas commissions are charges assessed for every deal.

Firstly, it presents streamlined operational effectivity by successfully dealing with key areas of your business, such as client administration, compliance, and IB management. Nevertheless, even this flagship digital forex grapples with maintaining what is a book vs b book favorable worth levels and attractive traders from outdoors the crypto realm. This is a transparent indication that the trade must revise its perspective and endeavor to use revolutionary blockchain know-how more pragmatically.

Choosing the right mode can dramatically impact your foreign exchange operations. This determination would depend on elements corresponding to the nature of your consumer base, the capabilities of your traders, and your corporation’s overarching goals. As a leading Forex CRM supplier, we can information you on this selection process to optimize your outcomes. Our Forex CRM System’s sales module allows you to customise consumer distribution settings primarily based in your preferences. This means you can route purchasers from completely different nations and with varying deposit amounts to particular managers or partners.

Forex trading moves over 6 trillion US dollars every day, principally in G10 nation currencies. Strict rules guarantee brokers keep excessive monetary requirements. If direct market entry and transparency are your priorities, A-Book brokers are suitable.

And because the name suggests, price threat switch describes the situation where a broker finds another get together to imagine the value threat and to run any potential losses. Usually, this is another dealer, a bank, or a non-bank market-maker. When deciding on a trading strategy, consider factors similar to your risk tolerance, most popular buying and selling fashion, and the level of transparency you search from your broker.

Financial operations are sometimes heavily regulated in multiple nations, especially when your operations are on a worldwide scale. Partnering with a regulated liquidity provider is one of the best approach to cut back dangers. Speaking about the most popular cryptocurrencies, most of them exhibit the very best cryptocurrency liquidity. Specialists advise in opposition to investing in assets with a trading quantity of lower than 10,000 coins per 24 hours. What methods can be used to tell apart reputable cryptocurrencies from scammy ones? Liquidity within the cryptocurrency market offers assistance to traders.